The Bureau of Labor Statistics (BLS) released its monthly Current Employment Statistics (CES) report and Current Population Survey (CPS) for August 2023 on Friday, September 1st. The monthly change in employment given by the CES and the unemployment rate from the CPS are seen as the standard gauges for assessing the health of the U.S. labor market.

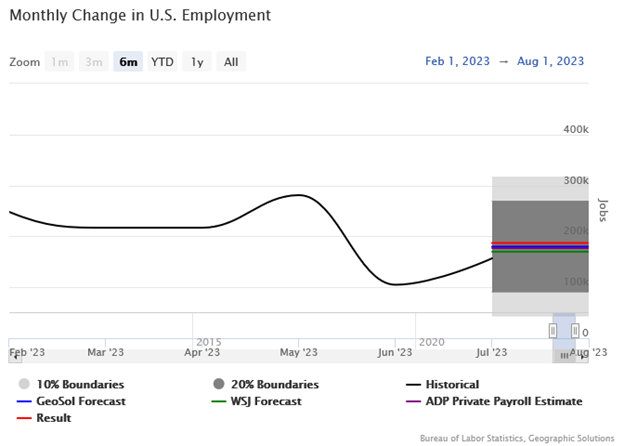

Employment in the U.S. rose by 187,000 jobs. The job results were slightly above the Geographic Solutions, Inc. forecast of 180,000 while the WSJ estimate was further away at 170,000. Geographic Solutions, Inc. derives its employment forecast from internal data on the number of job applications and job severances filed on Geographic Solutions state client sites. The forecast uses unemployment claims data from the U.S. Department of Labor (USDOL).

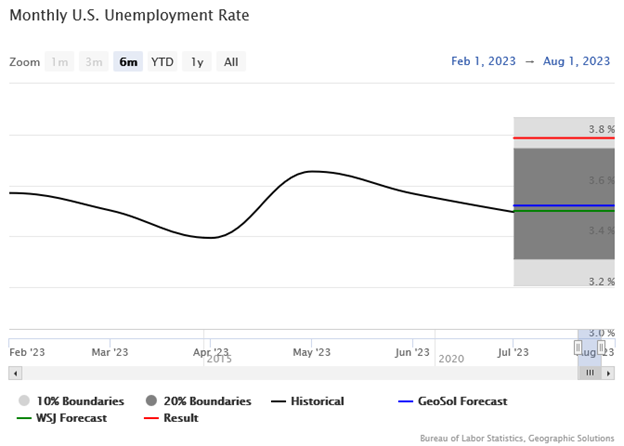

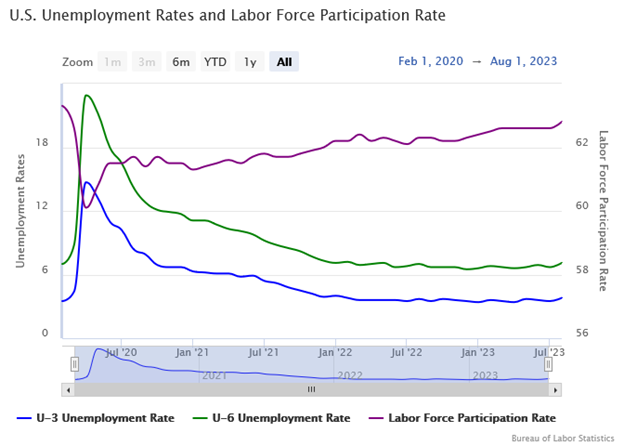

The unemployment rate rose to 3.8% in August. The Geographic Solutions forecast and the WSJ forecast projected the unemployment rate would maintain the 3.5% result from July. The unemployment rate forecast uses internal data on the number of job openings, job applications, job severances, and unemployment applications filed on Geographic Solutions state client sites. The forecast uses unemployment claims data from the U.S. Department of Labor.

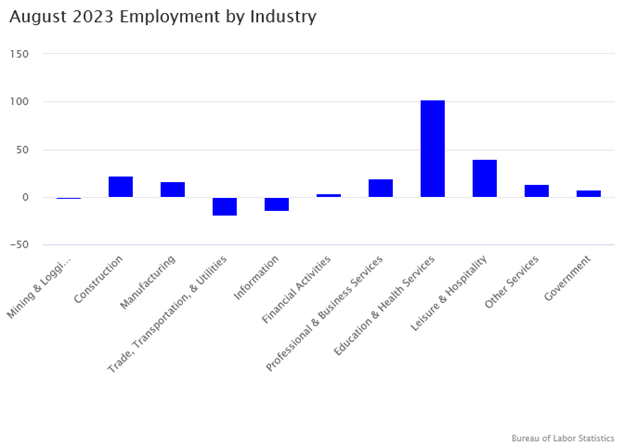

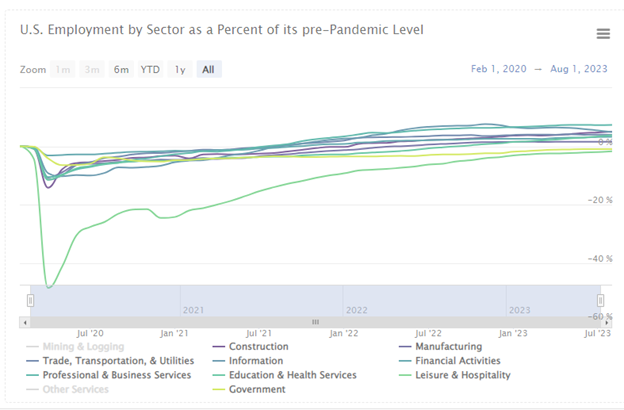

Job creation was strongest in the Education & Health Services (102,000) and Leisure & Hospitality (40,000) sector. Other sectors were modestly positive, but the Trade, Transportation, & Utilities and Information sectors lost jobs.

Leisure & Hospitality and Government are the only major sectors to remain below their pre-pandemic employment levels.

The labor force participation rate grew in August for the first time since March 2023, reaching 62.8%. The more expansive U-6 unemployment rate counts discouraged workers who are no longer actively seeking work (and therefore no longer in the labor force) and those that have settled for part-time employment but desire a full-time job. This measure of unemployment increased to 7.1%.

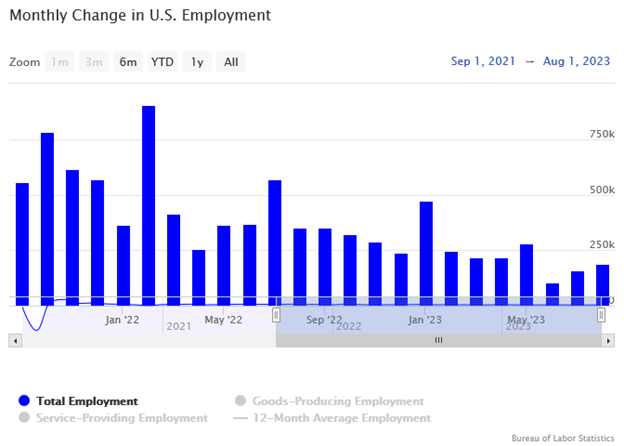

Employment noticeably softened during the summer, averaging only 150,000 new jobs per month from June through August after averaging 238,000 from March to May of this year. The 3.8% unemployment rate is also signaling some weakening in labor demand. Education & Health Services has led the way in job increases for the third straight month and made up the majority of new jobs in July and August. The Fed’s interest rate policy is having a moderating effect on the labor market. The near term prognosis for the labor market is likely sub-200,000 monthly job growth as the Fed’s interest rate hikes continue to work their way through the economy.