The Bureau of Labor Statistics (BLS) released its monthly Current Employment Statistics (CES) report and Current Population Survey (CPS) for January on Friday, February 3rd. The monthly change in employment given by the CES and the unemployment rate from the CPS are seen as the standard gauges for assessing the health of the U.S. labor market.

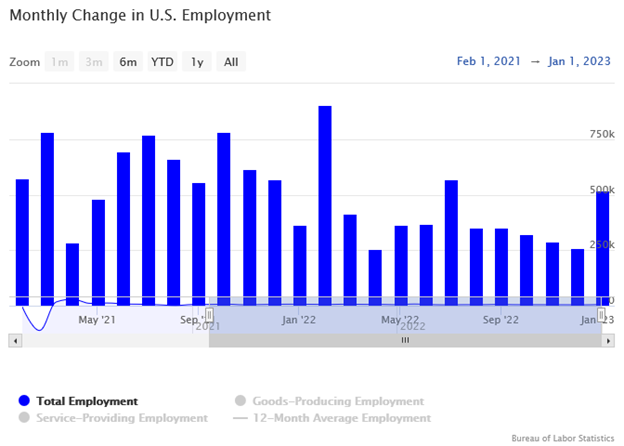

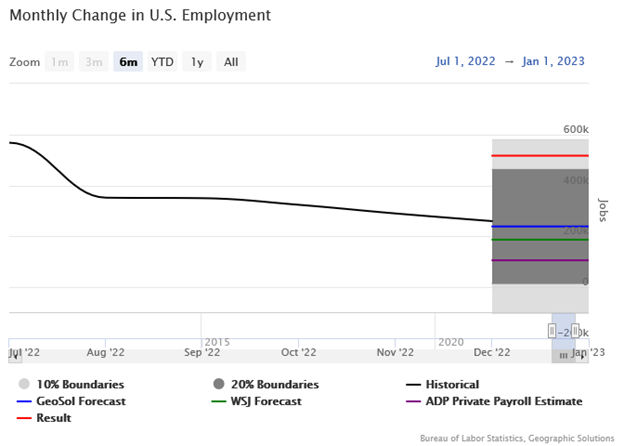

Employment in the U.S. rose by 517,000 jobs, the largest gain since July last year. The jobs results were well past expectations in the Geographic Solutions, Inc. forecast of 239,000. However, the forecast still outperformed the WSJ Economist Survey estimate of 187,000. Job growth has been slightly softening since August 2022, and despite the strong growth in employment in January, we expect this softening trend to reassert itself for the next few months. Geographic Solutions derives its employment forecast from internal data on the number of job openings, job searchers, job severances, and applications for unemployment benefits filed on Geographic Solutions state client sites. The forecast uses unemployment claims data from the U.S. Department of Labor (USDOL).

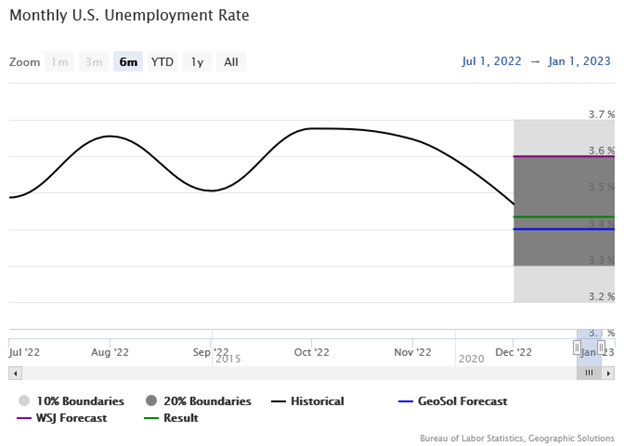

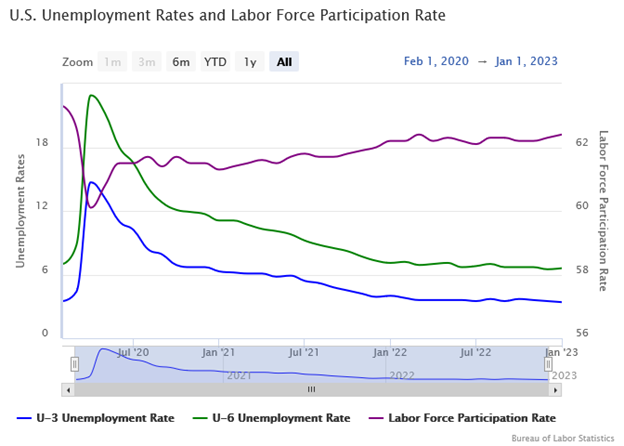

The unemployment rate fell to 3.4%, matching the Geographic Solutions forecast. The WSJ Economist Survey projected a higher unemployment rate of 3.6%. The unemployment rate forecast uses internal data on the number of job openings, job applications, unemployment applications, and job severances on Geographic Solutions state client sites. The forecast uses unemployment claims data from the USDOL.

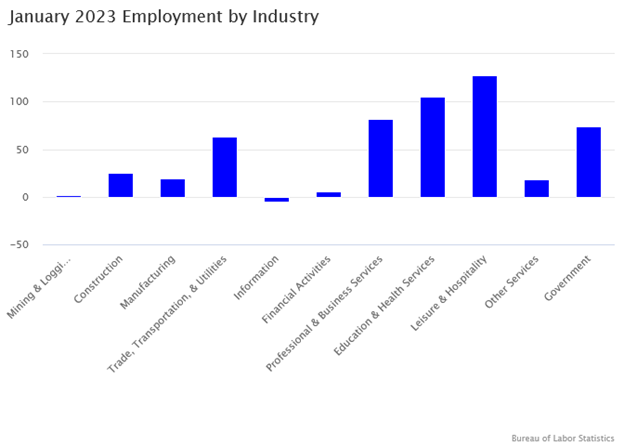

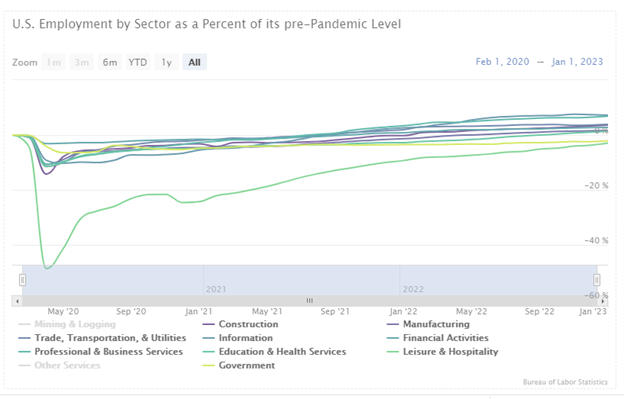

Job creation was strongest in Leisure & Hospitality (128,000) and Education & Health Services (105,000). Professional & Business Services (82,000), Government (74,000) and Trade, Transportation, & Utilities (63,000) also contributed substantially to January job gains. Other sectors were flat to slightly positive.

Leisure & Hospitality and Government are the only major sectors to remain below their pre-pandemic employment level.

The labor force participation rate increased to 62.4% from the previous month. The more expansive U-6 unemployment rate counts discouraged workers who are no longer actively seeking work (and therefore no longer in the labor force) and those that have settled for part-time employment but desire a full-time job. This measure of unemployment ticked up to 6.6%.

The surprisingly high job numbers for January combined with a further easing in wage growth provide reasons for optimism on taming inflation:

1) More employment translates to more production which can alleviate inflation from the supply side.

2) Easing wage growth can take pressure off producers to raise prices.

Employment will probably return to the 200,000 to 300,000 pace we have seen for the last few months before January. The Federal Reserve this week revealed that it was adopting a slower rate hike approach of 0.25% per month to see how its cumulative rate hikes for the last year will play out in the labor market and broader economy. The hope is that this breathing room will reveal that the Fed’s previous actions to reduce the inflation rate have taken hold and employers will be able to operate with more certainty on prices and interest rates.