The Bureau of Labor Statistics (BLS) released its monthly Current Employment Statistics (CES) report and Current Population Survey (CPS) for November 2022 on Friday, December 2nd. The monthly change in employment given by the CES and the unemployment rate from the CPS are seen as the standard gauges for assessing the health of the U.S. labor market.

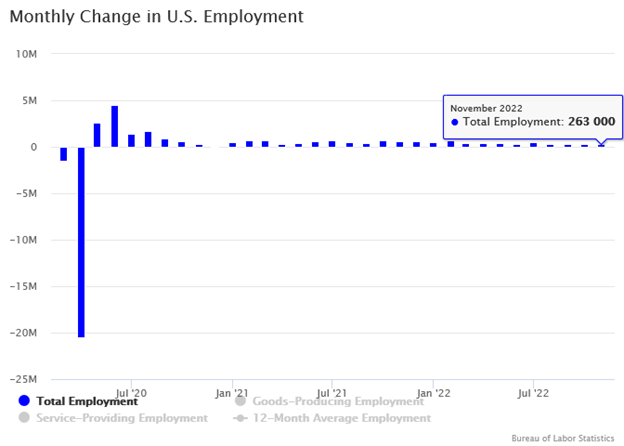

Employment in the U.S. rose by 263,000 jobs. The jobs report exceeded the Geographic Solutions, Inc. forecast of 152,000 and the WSJ forecast of 205,000. While the result is higher than expectations, it remains well within the prediction interval. Despite fluctuations among indicators pointing to a slower pace of job creation, initial estimates over the last three months have been remarkably locked in place with September reporting 263,000 initial new jobs, October reporting 261,000 initial new jobs, and November reporting 263,000 initial new jobs. Geographic Solutions, Inc. derives its employment forecast from internal data on the number of job openings, job searchers, job severances, and applications for unemployment benefits filed on Geographic Solutions state client sites. The forecast uses unemployment claims data from the U.S. Department of Labor (USDOL).

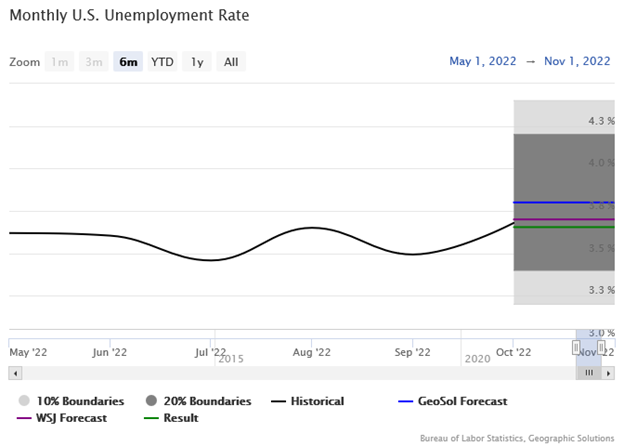

The unemployment rate remained at 3.7%, below the Geographic Solutions forecast of 3.8%. The WSJ forecast of 3.7% matched the result. The unemployment rate forecast used internal data on the number of job openings, job searchers, unemployment applications, and job severances on Geographic Solutions state client sites. The forecast uses unemployment claims data from the USDOL.

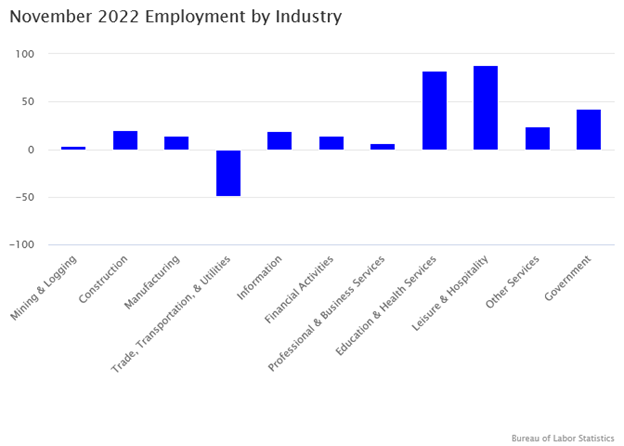

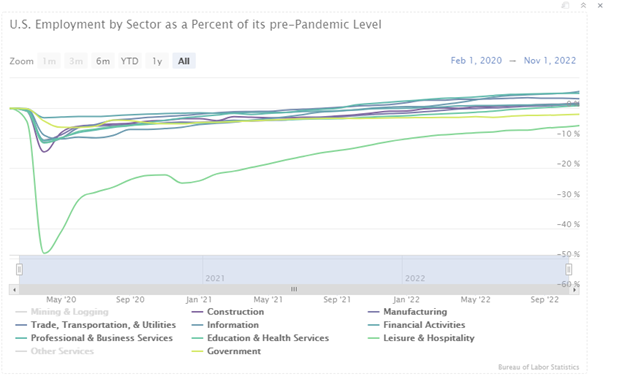

While all sectors continue to grow, Leisure & Hospitality and Government are the only major sectors to remain below their pre-pandemic employment level.

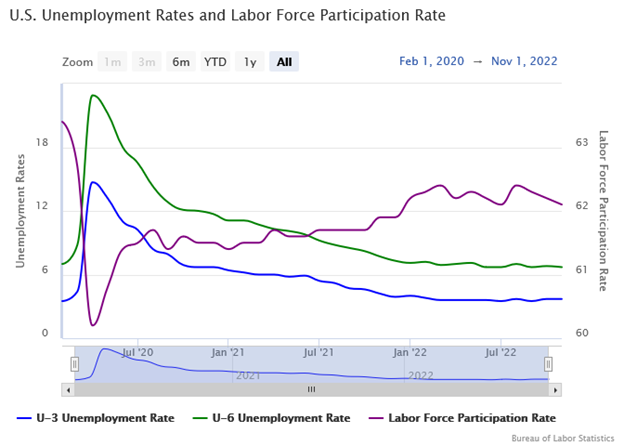

The labor force participation rate fell to 62.1% from the previous month. The more expansive U-6 unemployment rate counts discouraged workers who are no longer actively seeking work (and therefore no longer in the labor force) and those that have settled for part-time employment but desire a full-time job. This measure of unemployment declined to 6.7%.

The main takeaway from the report is that the labor market is still hiring at a healthy pace, even as fewer people remain in the labor force and the Federal Reserve continues to raise interest rates to dampen economic activity. Perhaps the overriding factor for these substantial month-to-month job gains is that the number of job openings continues to far exceed the number of those unemployed.